In the ever-changing world of technology and retai...

news-extra-space

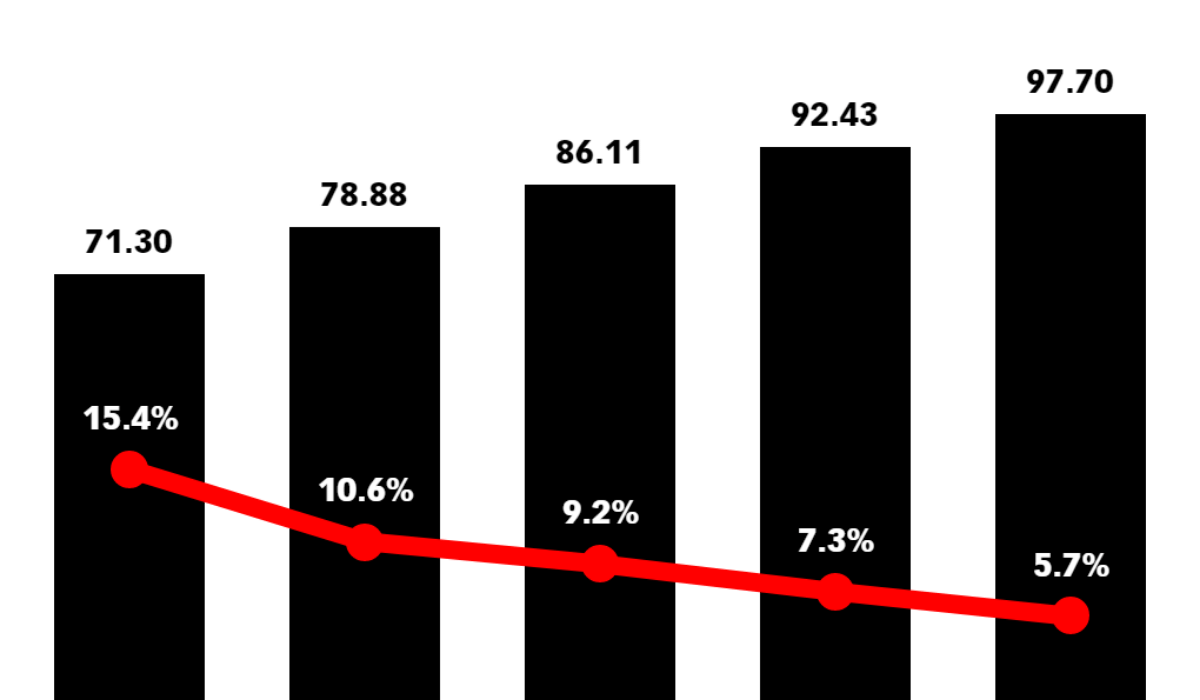

Apple shares grew in extended trading on Thursday on the back of iPhone and iPad sales, topping estimates and giving strong sales forecasts. But Wall Street has reason to be concerned based on the slowdown in services, which recorded growth of 27% in fiscal 2021 and 16% in 2020, the first year of the pandemic.

Investors generally like Apple’s move into services, because the products are more profitable than hardware and often bring in recurring revenue. The unit had a gross margin, or the profit left after accounting for the cost of goods sold, of 71.5% in the latest quarter, compared to Apple’s overall gross margin of 43.3%.

Morgan Stanley analysts wrote earlier this month that Apple’s long-term valuation could rise by 30% if the company focused on making money from its current customers through expanded services.

“We believe Apple shares undervalue the lifetime value of an Apple user,” Morgan Stanley analyst Erik Woodring wrote, citing services growth as a key investment driver.

Maestri said the services business performed in line with its expectations. And even with growth slowing to 12%, it still saw more robust expansion than the company as a whole, which grew by 2%.

Apple CEO Tim Cook said the services division was affected by the economic situation. In particular, he cited the company’s ads business, which is one of the smaller services.

Apple shares grew in extended trading on Thursday on the back of iPhone and iPad sales, topping estimates and giving strong sales forecasts. But Wall Street has reason to be concerned based on the slowdown in services, which recorded growth of 27% in fiscal 2021 and 16% in 2020, the first year of the pandemic.

Investors generally like Apple’s move into services, because the products are more profitable than hardware and often bring in recurring revenue. The unit had a gross margin, or the profit left after accounting for the cost of goods sold, of 71.5% in the latest quarter, compared to Apple’s overall gross margin of 43.3%.

Morgan Stanley analysts wrote earlier this month that Apple’s long-term valuation could rise by 30% if the company focused on making money from its current customers through expanded services.

“We believe Apple shares undervalue the lifetime value of an Apple user,” Morgan Stanley analyst Erik Woodring wrote, citing services growth as a key investment driver.

Maestri said the services business performed in line with its expectations. And even with growth slowing to 12%, it still saw more robust expansion than the company as a whole, which grew by 2%.

Apple CEO Tim Cook said the services division was affected by the economic situation. In particular, he cited the company’s ads business, which is one of the smaller services.

“Digital advertising was clearly impacted by the macroeconomic environment,” Cook said. “It’s a mixed bag in terms of what we believe that we saw.” Covid-19 shutdowns may have also made services growth “lumpy,” leading to difficult year-over-year comparisons, Maestri said.

“There have been lockdowns and reopenings and so on,” Maestri said. “So it’s very difficult to talk about a steady-state growth rate for our services business.”

Maestri said the number of iPhone users is still growing, suggesting that the services business can continue to expand by bringing in new customers. He added that music, cloud services, AppleCare warranties, and payments all hit record revenue levels during the quarter.

“Digital advertising was clearly impacted by the macroeconomic environment,” Cook said. “It’s a mixed bag in terms of what we believe that we saw.” Covid-19 shutdowns may have also made services growth “lumpy,” leading to difficult year-over-year comparisons, Maestri said.

“There have been lockdowns and reopenings and so on,” Maestri said. “So it’s very difficult to talk about a steady-state growth rate for our services business.”

Maestri said the number of iPhone users is still growing, suggesting that the services business can continue to expand by bringing in new customers. He added that music, cloud services, AppleCare warranties, and payments all hit record revenue levels during the quarter.

Leave a Reply