In the ever-changing world of technology and retai...

news-extra-space

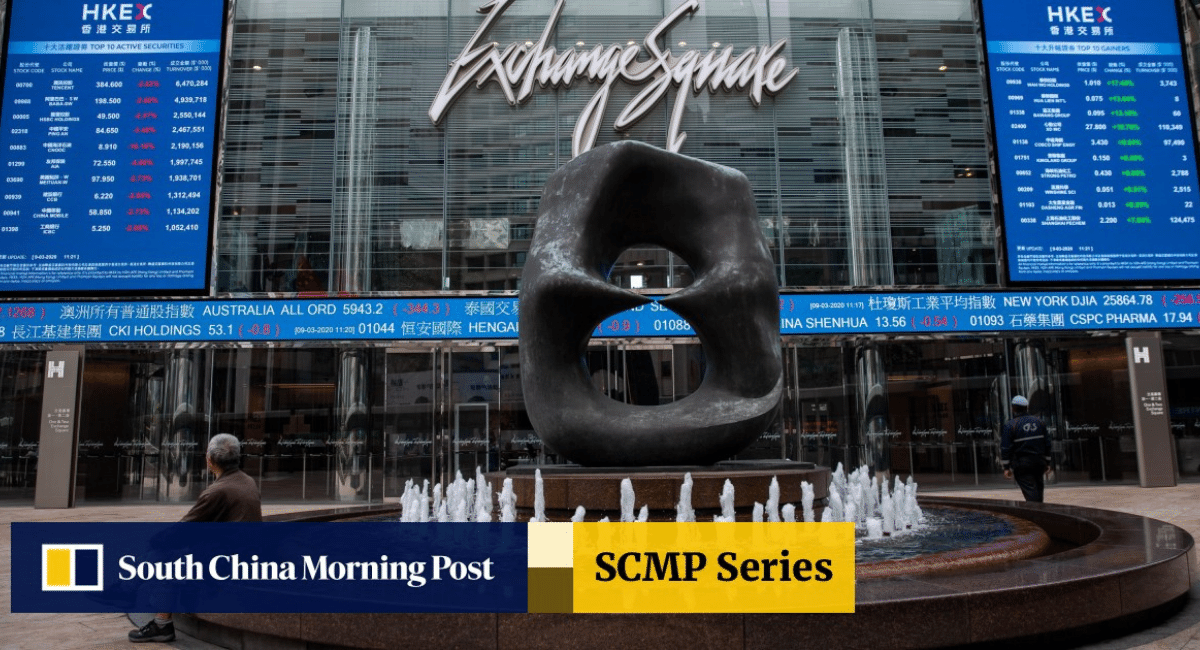

Converting the secondary listing to the primary listing is quite expensive and takes a lot of time. But ultimately, it gets easier to access a vast capital in the central city. Alibaba Group plans to complete the listing by the year-end with a dual listing in Hong Kong and New York.

A dual-primary listing has many more strict rules and will have to produce a schedule of when the requirements will be met. In addition, many U.S.-listed Chinese companies are under immense pressure from the U.S. Exchange Commission and Securities to access their audit papers and, if not, will be delisted.

Converting the secondary listing to the primary listing is quite expensive and takes a lot of time. But ultimately, it gets easier to access a vast capital in the central city. Alibaba Group plans to complete the listing by the year-end with a dual listing in Hong Kong and New York.

A dual-primary listing has many more strict rules and will have to produce a schedule of when the requirements will be met. In addition, many U.S.-listed Chinese companies are under immense pressure from the U.S. Exchange Commission and Securities to access their audit papers and, if not, will be delisted.

Alibaba is not the only company going through this process but will be followed by many others. The main reason for switching to primary listing is that the USA cannot delist you, and if you get delisted, you can continue to trade the stocks. Alibaba group's shares rose by 5% after the announcement was made public, which had earlier closed at 4.82% at HK$104.4 in Hong Kong.

Daniel Zhang, Alibaba Group chairman, and CEO stated, "fostering a wider and more diversified investor base to share in Alibaba's growth and future, especially from China and other markets in Asia." Compared to primary listing, the secondary listing is exempted from some rules. As a result, Alibaba tops the list of secondary listings in Hong Kong.

Mike Leung, an investment manager at Hong Kong Wocom Securities, states that the move from the Alibaba group was expected and that more Chinese companies in the U.S. will follow suit as the American regulators will follow tighter scrutiny. Leung added, "I believe that this move is motivated by political considerations,"

Alibaba is not the only company going through this process but will be followed by many others. The main reason for switching to primary listing is that the USA cannot delist you, and if you get delisted, you can continue to trade the stocks. Alibaba group's shares rose by 5% after the announcement was made public, which had earlier closed at 4.82% at HK$104.4 in Hong Kong.

Daniel Zhang, Alibaba Group chairman, and CEO stated, "fostering a wider and more diversified investor base to share in Alibaba's growth and future, especially from China and other markets in Asia." Compared to primary listing, the secondary listing is exempted from some rules. As a result, Alibaba tops the list of secondary listings in Hong Kong.

Mike Leung, an investment manager at Hong Kong Wocom Securities, states that the move from the Alibaba group was expected and that more Chinese companies in the U.S. will follow suit as the American regulators will follow tighter scrutiny. Leung added, "I believe that this move is motivated by political considerations,"

"Given the current political tension between China and the U.S., the risk of delisting from the U.S. is quite high." In May, BiliBili Inc., an online entertainment portal, said it would convert its current status to a dual-primary listing in October. The same action could be followed by the online JD.Com and video game store NetEase Inc.

"Given the current political tension between China and the U.S., the risk of delisting from the U.S. is quite high." In May, BiliBili Inc., an online entertainment portal, said it would convert its current status to a dual-primary listing in October. The same action could be followed by the online JD.Com and video game store NetEase Inc.

Leave a Reply