Amazon Freevee, a progressive no-subscription stre...

news-extra-space

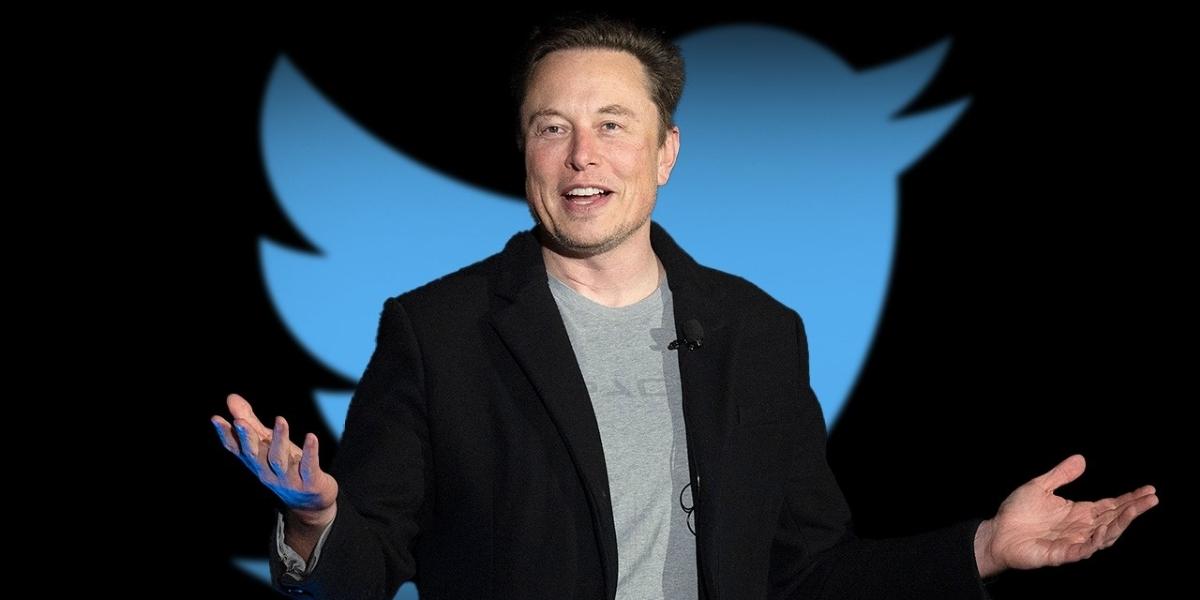

Tesla shareholders expressed anxiety over Musk's ownership of Twitter, which he recently purchased for $44 billion, prompting a sell-off of the stock.

Investors contend that Musk's involvement with the social networking platform is detrimental to Tesla, and they cite the stock price of the company to bolster their arguments.

According to reports, the stock of Tesla, which was trading at $156.80 after hours on Wednesday, has dropped 60.8% since January and is on track to have its worst annual performance.

Analysts speculate that Musk's move to sell shares may have something to do with the high-interest debt he is now making payments on in connection with the acquisition of Twitter.

Tesla shareholders expressed anxiety over Musk's ownership of Twitter, which he recently purchased for $44 billion, prompting a sell-off of the stock.

Investors contend that Musk's involvement with the social networking platform is detrimental to Tesla, and they cite the stock price of the company to bolster their arguments.

According to reports, the stock of Tesla, which was trading at $156.80 after hours on Wednesday, has dropped 60.8% since January and is on track to have its worst annual performance.

Analysts speculate that Musk's move to sell shares may have something to do with the high-interest debt he is now making payments on in connection with the acquisition of Twitter.

According to the terms of the deal, Twitter agreed to take on $13 billion in debt, $3 billion of which was unsecured and has an interest rate of 11.75%.

Some of Tesla's most fervent owners are pleading with Musk and the board to consider repurchasing shares as the company's stock price drops further.

Musk said at the company's Q3 earnings that Tesla is expected to perform a repurchase next year, probably for between $5 billion and $10 billion.

On the same day that Musk revealed his most recent stock sell-off, the Federal Reserve raised its benchmark interest rate, putting it to a range between 4.25% and 4.5%.

According to reports, as stock values often fall as interest rates rise, Musk may have been selling in anticipation of Tesla shares losing further value in the coming weeks.

According to the terms of the deal, Twitter agreed to take on $13 billion in debt, $3 billion of which was unsecured and has an interest rate of 11.75%.

Some of Tesla's most fervent owners are pleading with Musk and the board to consider repurchasing shares as the company's stock price drops further.

Musk said at the company's Q3 earnings that Tesla is expected to perform a repurchase next year, probably for between $5 billion and $10 billion.

On the same day that Musk revealed his most recent stock sell-off, the Federal Reserve raised its benchmark interest rate, putting it to a range between 4.25% and 4.5%.

According to reports, as stock values often fall as interest rates rise, Musk may have been selling in anticipation of Tesla shares losing further value in the coming weeks.

Leave a Reply