In the ever-changing world of technology and retai...

news-extra-space

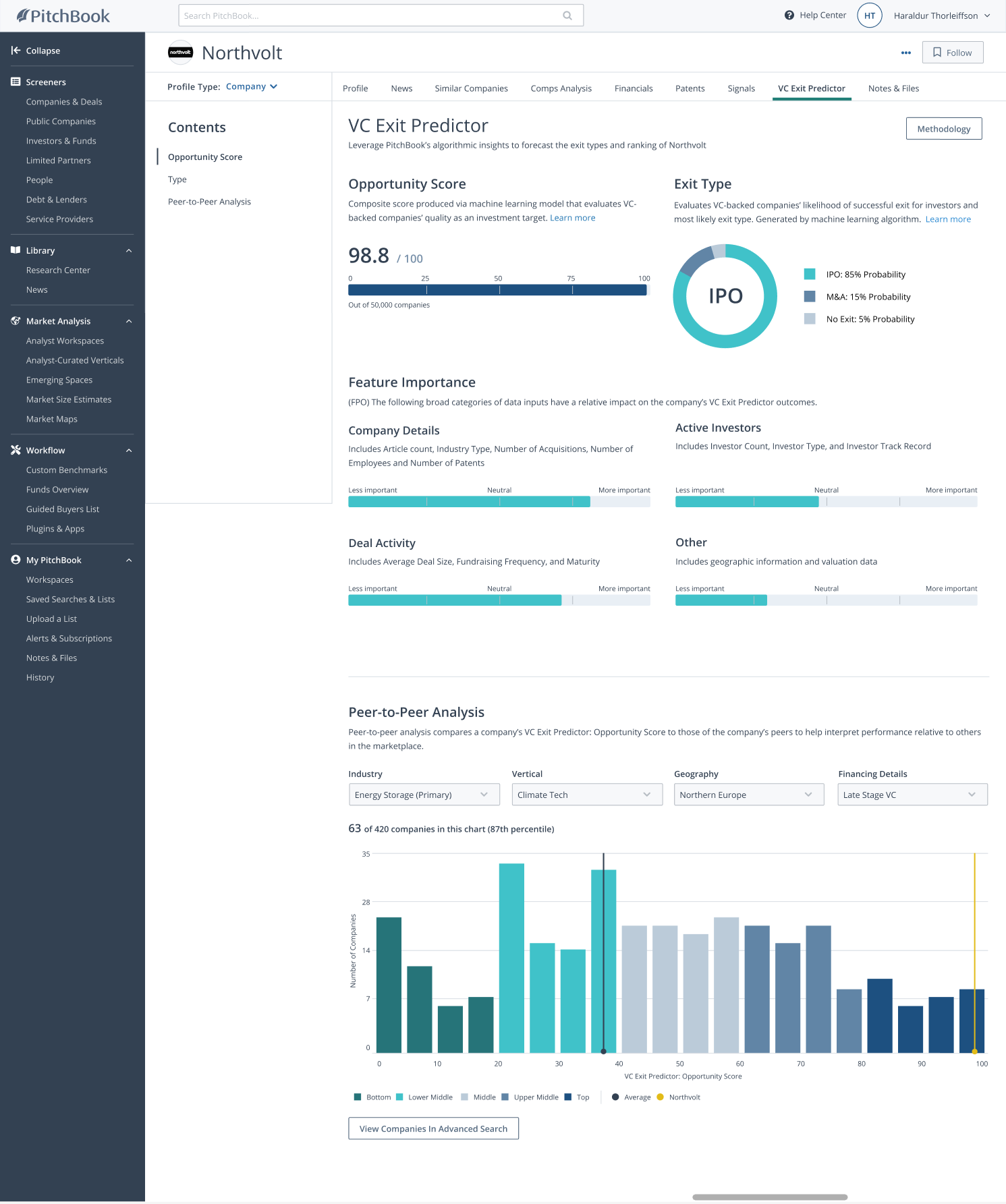

Image credit- TechCrunch[/caption]

The technique is only applied to venture-backed businesses that have received at least two rounds of venture financing in order to guarantee the accuracy of projections.

Investors have long used AI-driven platforms to make investment decisions, thus PitchBook is not the first to create such an automated tool. According to TechCrunch, VC firms like SignalFire, EQT Ventures, and Nauta Capital have begun utilizing AI-powered tools to find prospective top companies.

A group of researchers also developed a tool in 2021 that was akin to the VC Exit Predictor and used publicly available CrunchBase data to forecast whether firms will fail, go private, or exit through an IPO or acquisition.

McGinn claims that PitchBook's VC Exit Predictor was back-tested using a historical sample of businesses with known exits, including Blockchain.com, Revolut, and Bitso. The tool purportedly predicted a successful escape throughout the set with an average accuracy of 74%.

[caption id="" align="aligncenter" width="2884"]

Image credit- TechCrunch[/caption]

The technique is only applied to venture-backed businesses that have received at least two rounds of venture financing in order to guarantee the accuracy of projections.

Investors have long used AI-driven platforms to make investment decisions, thus PitchBook is not the first to create such an automated tool. According to TechCrunch, VC firms like SignalFire, EQT Ventures, and Nauta Capital have begun utilizing AI-powered tools to find prospective top companies.

A group of researchers also developed a tool in 2021 that was akin to the VC Exit Predictor and used publicly available CrunchBase data to forecast whether firms will fail, go private, or exit through an IPO or acquisition.

McGinn claims that PitchBook's VC Exit Predictor was back-tested using a historical sample of businesses with known exits, including Blockchain.com, Revolut, and Bitso. The tool purportedly predicted a successful escape throughout the set with an average accuracy of 74%.

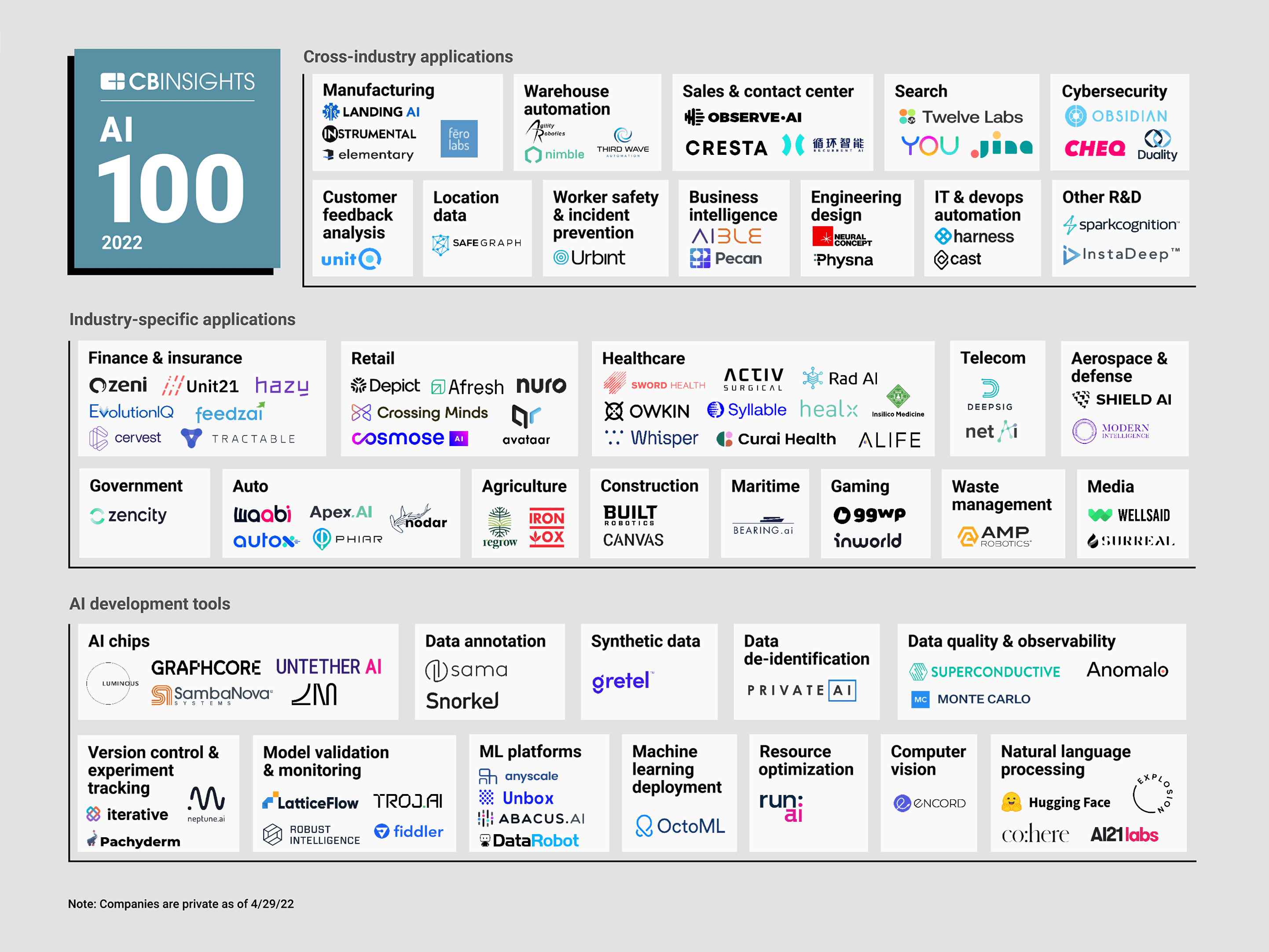

[caption id="" align="aligncenter" width="2884"] Image credit- CB Insights Research[/caption]

Venture capitalists looking for a data-driven strategy for their initial assessment of a venture-backed company may use VC Exit Predictor.

According to McGinn, the tool may also be helpful for market competitors, industry participants looking for potential IPO candidates, and investors looking for confirmation before their next round of funding.

Employing algorithmic techniques raises concerns about their resistance to unforeseen events like pandemics, wars, and natural disasters. According to a statement by McGinn, the system has limitations regarding market-level predictions.

The approach takes longer to adapt to thriving or failing segments since it depends on frequent updates in a slower-moving market area.

Also read: Snaptrude gets VC backing to disrupt Autodesk in building design space

Is it possible for VC Exit Predictor to reliably forecast the results of such events? Yet according to PitchBook, VC Exit Predictor is useful for investors searching for data-driven methods to make wise investment choices.

Image credit- CB Insights Research[/caption]

Venture capitalists looking for a data-driven strategy for their initial assessment of a venture-backed company may use VC Exit Predictor.

According to McGinn, the tool may also be helpful for market competitors, industry participants looking for potential IPO candidates, and investors looking for confirmation before their next round of funding.

Employing algorithmic techniques raises concerns about their resistance to unforeseen events like pandemics, wars, and natural disasters. According to a statement by McGinn, the system has limitations regarding market-level predictions.

The approach takes longer to adapt to thriving or failing segments since it depends on frequent updates in a slower-moving market area.

Also read: Snaptrude gets VC backing to disrupt Autodesk in building design space

Is it possible for VC Exit Predictor to reliably forecast the results of such events? Yet according to PitchBook, VC Exit Predictor is useful for investors searching for data-driven methods to make wise investment choices.

Leave a Reply